Uncategorised

Switch to eInvoicing

EInvoicing is a government initiative designed to make the exchange of electronic invoices more efficient via your accounting software. Once the sender generates the invoice within their software, the information will be directly sent to the receiver, ready to be approved and paid for.

EInvoicing enables better control over your invoicing by:

- Automatically appearing in your software to reduce the need to manually enter the invoices

- Using the ABN (Australian Business Number) of your trading partner as well as validating key details before the eInvoices are sent. This then removes the need to follow up the invoices that were incorrectly addressed or lost.

- Removing the manual entry of invoices to eliminate the time-consuming and costly errors

- Delivering the invoices with real-time information that can be accessed in your accounting software

- Limiting the fake or compromised invoices as well as other false billing scams

- Allowing you to seamlessly trade with other eInvoicing-enabled businesses across Australia and worldwide.

This process can be implemented easy and efficiently. For more information about these measures ask your accounting software provider or click here. However, if you do not currently use an accounting software, there are several free and low-cost options available.

How does Xero incorporate eInvoicing?

EInvoicing software is similar to Xero as it allows the eInvoices to be exchanged efficiently and safely amongst the government and other businesses. Hence why we highly recommend Xero as your go to accounting software.

Get started with eInvoicing with Xero within a few steps.

- Within Xero, you can register via the Peppol network by using your ABN and it’s a free service.

- In Xero enter your ABN, then enter your chosen customer’s ABN to ensure they are registered within the Peppol Network.

- The eInvoices will be received automatically from the supplier which reduces the risk of misdirected emails or letters. This also means there is no need to manually enter the data into the invoice. These eInvoices can be viewed as draft bills via the Xero app or on your laptop, ready to be approved and paid for.

For more details on how it works in Xero check out the following Xhelp guide: Register to receive eInvoices – Xero Central

Removing the $450 monthly threshold for super guarantee eligibility

Provided that their employees still meet the super guarantee eligibility criteria, employers will be required to make super contributions into their eligible employee’s super fund, starting 1 July 2022.Employers will also be required to review their updated payroll and accounting systems to ensure that any super payments made after 1 July 2022 are accurately calculated into their employee’s super guarantee entitlement.

From 1 July 2022, online tools and calculators will be available to assist in implementing this change.

For more information about these measures, click here.

Affected by Floods? Discover Disaster Support for your Business!

It is encouraged that businesses follow Business Queensland on Facebook or check their website to stay up to date on available assistance. You may also contact the business hotline on 1300 654 687.

What support can you receive?

1. Small Business Disaster HUB

The Small Business Disaster Hub website offers resources and information to businesses that help them respond and recover following a natural disaster. This can include:

- What your business should do following a natural disaster – insurance and tips for cleaning up

- Rebuilding your business after a natural disaster – re-establishing your premises, business records, finances, staff, and planning.

2. Financial Assistance

Eligible flood-affected communities are available for financial assistance.

- Emergency Hardship Assistance Grants are available to support those who were directly impacted by a disaster and are unable to meet their essential needs for food, clothing & accommodation. Eligible applicants can receive $180 per person up to $900 for a family of five or more. For more information visit www.qld.gov.au/community/disasters-emergencies.

- Essential Household Content Grants of up to $1765 for single adults and up to $5,300 for couples/ families. This is available for uninsured people. Eligible applicants may receive financial assistance towards replacing and repairing essential household contents. E.g., beds, linen, and white goods.

Australian Government Disaster Recovery Payment is a single payment for eligible people who were adversely affected by the Southeast Queensland floods.

Disaster Recovery Allowance is a short-term payment to help people who have lost income as a direct result of the floods in Southeast Queensland.

3. Legal Aid Queensland

The Legal Aid Natural Disaster Helpline (1300 527 700) is something that businesses can call to get help with issues they may face when a property has been damaged by a natural disaster. Legal Aid has a range of resources available to support businesses that have been impacted by flooding on leased or commercial properties.

4. Mental Health Support

The Queensland and Australian Governments have developed a range of mental health and wellbeing resources to help support small business owners.

5. Natural Disasters Business Survey

The Natural Disaster Business Survey was opened by the Department of Employment, Small Business, and Training, to understand the impact of rainfall and flooding on businesses in Southeast Queensland.

This is a long-term plan designed to assist businesses. Responses received from this process are used to inform potential joint State and Federal government disaster recovery assistance for small businesses.

For any further information click here.

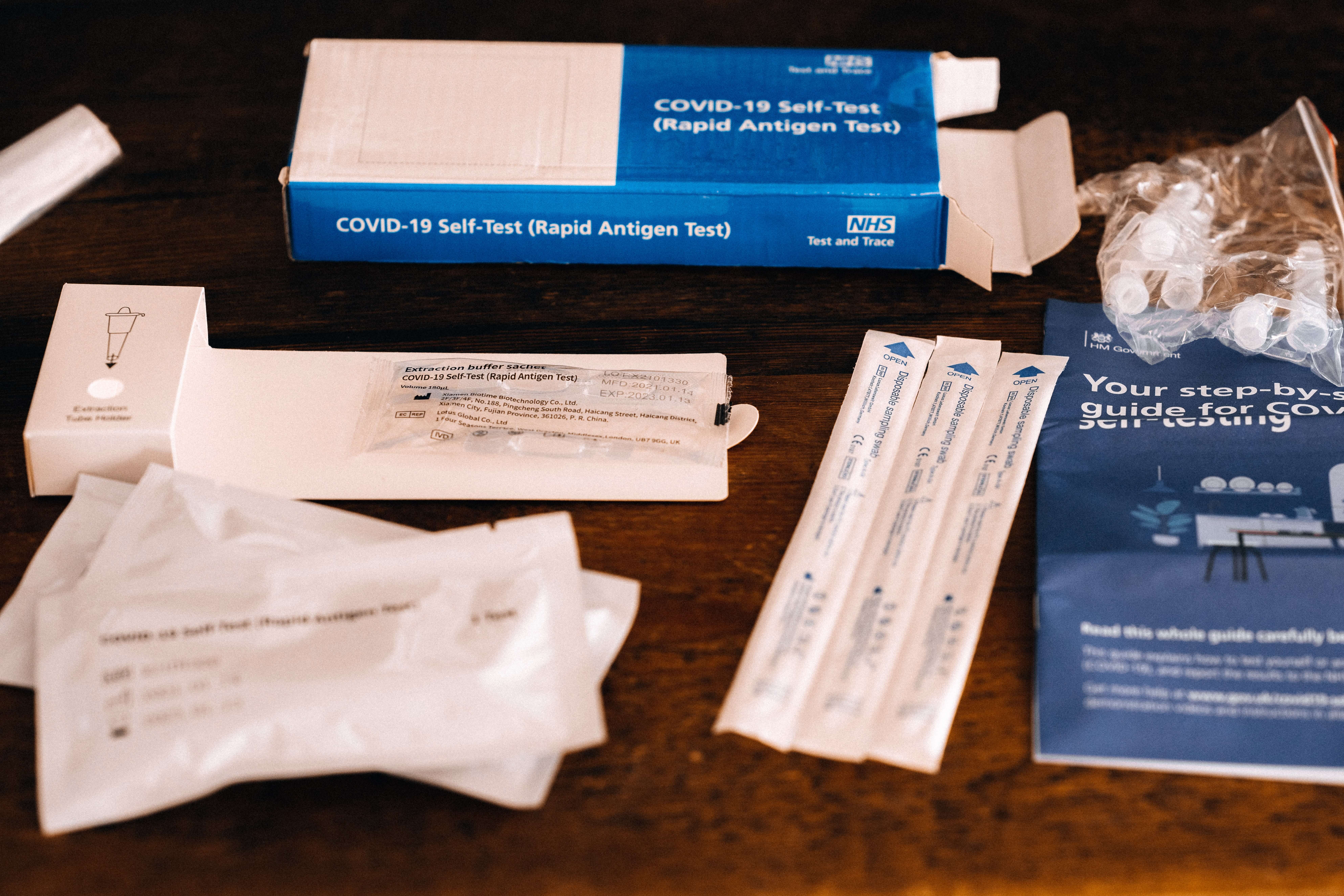

Tax Deductibility of RAT’s

In a recent address to the Australian Industry Group (7th February 2022), Treasurer Josh Frydenberg confirmed the federal government would look to ensure COVID-19 Rapid Antigen Tests (RAT’s) are tax-deductible.

“Today, I’m announcing that we will ensure that COVID19 testing expenses are tax deductible for testing taken to attend a place of work, giving businesses and individuals more clarity and assurance”, the Treasurer said.

Australians will now be able to claim a tax deduction on RAT’s that they buy as part of their work.

“We will also ensure that fringe benefits tax (FBT) will not be incurred by employers where RATs are provided to employees for this purpose.”

This means that Employers will also gain an exemption from fringe benefits tax for the kits as well as other coronavirus tests under draft laws to be put to Parliament within days to cut the cost of checking that workplaces are safe.

Whilst employers have previously assumed that RAT’s have been tax-deductible, the treasurer’s statement has confirmed this as well as the exemption of fringe benefits tax.

These updates will apply to this financial year. A small business would reduce its fringe benefits tax bill by about $20 every time a dual pack of RAT’s are bought for $20 and provided to employees, according to government estimates.

For further detail, read more on the treasurer’s conversation here.

You may also like:

Rewarding Staff for Covid-19 Vaccine

New residential construction stimulus package

Treasury has announced a new time-limited grant program HomeBuilder to help the residential construction market to bounce back from the Coronavirus crisis. The grant scheme provides eligible owner-occupiers (including first home buyers) with a grant of $25,000 to build a new home or substantially renovate an existing home.

To access HomeBuilder, owner-occupiers must meet the following eligibility criteria:

- you are a natural person (not a company or trust);

- you are aged 18 years or older;

- you are an Australian citizen;

- you meet one of the following two income caps:

- $125,000 per annum for an individual applicant based on your 2018-19 tax return or later; or

- $200,000 per annum for a couple based on both 2018-19 tax returns or later;

- you enter into a building contract between 4 June 2020 and 31 December 2020 to either:

- build a new home as a principal place of residence, where the property value does not exceed $750,000 including the land; or

- substantially renovate your existing home as a principal place of residence, where the renovation contract is between $150,000 and $750,000, and where the value of your property prior to renovating is less than $1.5 million;

- construction must commence within three months of the contract date.

Some important notes:

Owner-builders and those seeking to build a new home or renovate an existing home as an investment property are ineligible for HomeBuilder.

Additionally, renovation works must be to improve the accessibility, safety, and livability of the dwelling. It cannot be for additions to the property such as swimming pools, tennis courts, outdoor spas and saunas, sheds.

In negotiating a building contract, the parties must deal with each other at arm’s length. This means the contract must be made by two parties freely and independently of each other, and without some special relationship, such as being a relative.

The terms of the contract must be commercially feasible, and the contract price not inflated compared to the fair market price. Renovations or building work must be undertaken by a registered or licensed building service “contractor” (under relevant state or territory laws) and named as the builder on the building license or permit.

For more information, check out the Treasury website.

Don’t forget to share this post! Or check out some of our latest articles:

Tips to create a work from home schedule that works for you

How to engage with customers during COVID-19

Coronavirus effects & How we can help

Updated 02 April 2020

Job Keeper Payment for employers and employees

The government has announced a $130 billion dollar allowance to help keep more Australians in jobs.

Under the JobKeeper Payment, businesses impacted by the coronavirus outbreak will be able to access a subsidy from the Government to continue paying their employees. Affected employers will be able to claim a fortnightly payment of $1,500 per eligible employee from 30 March 2020, for a maximum period of 6 months.

Employers will be eligible for the subsidy if:

- their business has a turnover of less than $1 billion and their turnover will be reduced by more than 30 per cent relative to a comparable period a year ago (of at least a month); or

- their business has a turnover of $1 billion or more and their turnover will be reduced by more than 50 per cent relative to a comparable period a year ago (of at least a month); and

- the business is not subject to the Major Bank Levy.

The employer must have been in an employment relationship with eligible employees as at 1 March 2020 and confirm that each eligible employee is currently engaged in order to receive Job Keeper Payments. Not-for-profit entities (including charities) and self-employed individuals (businesses without employees) that meet the turnover tests that apply for businesses are eligible to apply for Job Keeper Payments.

Eligible employees are employees who:

- are currently employed by the eligible employer (including those stood down or re-hired);

- were employed by the employer at 1 March 2020;

- are full-time, part-time, or long-term casuals (a casual employed on a regular basis for longer than 12 months as at 1 March 2020);

- are at least 16 years of age;

- are not in receipt of a JobKeeper Payment from another employer. If your employees receive the JobKeeper Payment, this may affect their eligibility for payments from Services Australia as they must report their JobKeeper Payment as income.

Payment process

Eligible employers will be paid $1,500 per fortnight per eligible employee. Eligible employees will receive, at a minimum, $1,500 per fortnight, before tax, and employers are able to top-up the payment.

Where employers participate in the scheme, their employees will receive this payment as follows.

- If an employee ordinarily receives $1,500 or more in income per fortnight before tax, they will continue to receive their regular income according to their prevailing workplace arrangements. The JobKeeper Payment will assist their employer to continue operating by subsidising all or part of the income of their employee(s).

- If an employee ordinarily receives less than $1,500 in income per fortnight before tax, their employer must pay their employee, at a minimum, $1,500 per fortnight, before tax.

- If an employee has been stood down, their employer must pay their employee, at a minimum, $1,500 per fortnight, before tax.

- If an employee was employed on 1 March 2020, subsequently ceased employment with their employer, and then has been re-engaged by the same eligible employer, the employee will receive, at a minimum, $1,500 per fortnight, before tax.

- It will be up to the employer if they want to pay superannuation on any additional wage paid because of the JobKeeper Payment.

Payments will be made to the employer monthly in arrears by the ATO.

To apply, visit the business.gov.au page for more information. Check out the JobKeeper Factsheet – frequently asked questions for more details.

NEXT STEP:

Feel free to contact us for further details and to discuss your business situation. We’re here to help!

***

Updated 24 March 2020

In response to the coronavirus threat, the Australian Government has increased its support for Australian businesses during this period of economic uncertainty. Assistance includes larger cash payments to small businesses and temporary measures to provide relief for financially distressed businesses.

This page provides you with information about assistant packages and support for businesses. Our team at RA Business Advisors will be monitoring and updating this page when new information is available.

A. Support from the Federal Government (apply to all SMEs)

To this point, the Australian Government has announced 2 Economic Stimulus packages to the sum of $189bn. The cash and tax incentive measures are as followed:

1) 100% Cashback on PAYG Withholding, up to $100,000 in total

- Eligible small and medium-sized employers will receive a payment equal to 100% of their salary and wages withheld (up from 50%) with a maximum of $50,000 and minimum of $10,000 between 1 January 2020 and 30 June 2020.

- An additional payment is also being introduced in the July – October 2020 period. Eligible entities will also receive an additional payment equal to the total of all the Boosting Cash Flow for Employers payments they have received. In total, eligible entities will receive at least $20,000 up to a total of $100,000 under both payments.

- This second payment is calculated as the total cash back credit calculate in the first payment, split evenly over the June-20 to September 20 BAS/IAS lodgment period.

- To summarize, the cash back is now calculated on 100% of PAYGW of your wages, paid in 2 separate calculation periods:

| Payment | Calculation period | Calculation method | Benefit |

| Payment 1 | 1 Jan 2020 – 30 June 2020 | 100% of PAYGW | Capped at $50,000 for the period, with a minimum of $10,000 |

| Payment 2 (additional) | 30 June 2020 – 30 September 2020 | 100% of PAYGW

| Capped at $50,000 for the period, with a minimum of $10,000 |

*Eligibility for Payment 1 (Boosting Cash Flow for Employers payments): Small and medium sized business entities and NFPs with aggregated annual turnover under $50 million and that employ workers will be eligible. Eligibility will generally be based on prior year turnover.

For more information, please visit the Treasury page and the ATO website.

2) 50% subsidy on apprentice wages, up to $21,000

- Eligible employers can apply for a wage subsidy of 50% of apprentice or trainee’s wage paid during the 9 months from 1 January 2020 to 30 September 2020. Employers can be reimbursed up to a maximum of $21,000 per eligible apprentice or trainee.

- If a small business is not able to retain an apprentice, the subsidy will be available to a new employer that employs that apprentice.

Further information is available at:

- Treasury website

- The Department of Education, Skills and Employment website

- Australian Apprenticeships website

3, Tax incentives for Small Business Owners

- The immediate tax deduction threshold has been increased from $30,000 to $150,000 for assets purchased between 12 March 2020 and 30 June 2020.

- Assets over $150,000 will attract an additional 50 percent depreciation rate of the asset cost in the year of purchase for assets purchased between 12 March 2020 and 30 June 2021

Note:

- It’s important to note that these are tax incentives, not cash back incentives. You need to spend the money and pay income tax to get the tax benefit.

- The tax benefits will be applicable for your FY20 and FY21 tax returns, so you won’t see any benefit until you’ve lodged your 2020 and 2021 returns.

4, Tax Payment Deferrals

The ATO is providing SMEs payment deferral concessions for businesses directly impacted by COVID-19.

- Deferring by up to 4 months the payment date of amounts due through the business activity statement (including PAYG instalments), income tax assessments, fringe benefits tax assessments and excise.

- Businesses that report quarterly can move to monthly reporting to get faster access to GST refunds they are entitled to.

- Allowing businesses to vary PAYG instalment amounts to zero for the March 2020 quarter. Businesses that vary their PAYG instalment to zero can also claim a refund for any instalments made for the September 2019 and December 2019 quarters.

- Remitting any interest and penalties, incurred on or after 23 January 2020, that have been applied to tax liabilities.

- The ATO will discuss with affected businesses to help them pay their existing and ongoing tax liabilities by allowing them to enter into low interest payment plans.

Note:

- These relief provisions are not automatically applied. You will need to contact the ATO to make any of the above requests for assistance.

- Businesses can call the ATO’s Emergency Support Infoline on 1800 806 218 to discuss relief options based on needs and circumstances.

5, Coronavirus SME Guarantee Scheme – provide access to working capital

- Under the Scheme, the Government will provide a guarantee of 50% of new loans issued by eligible lenders to SMEs.

- The Government’s support will enhance lenders’ willingness and ability to provide credit to SMEs with the Scheme able to support $40 billion of lending to SMEs. This will allow small businesses to get access to credit faster.

To apply:

- Contact your bank/lending institution about this package.

- Refer to the ‘Coronavirus SME Guarantee Scheme’ and ask what new loan products are available to assist.

B. BUSINESS CONTINUITY PLANNING

As a business owner, now is the time to plan for employees being away from your workplace, shortages of supply, reduction in sales, and the possibility of your workplace being closed for a period of time if everybody is being forced to self-quarantine.

One of the resources we have available is a “Business Continuity Plan” which has been developed exclusively to deal with the coronavirus implications. The document includes important considerations such as:

- Employees working from home, and workplace obligations

- How to pay your bills in the short term if your sales start to dry up

- How to communicate in a reassuring way with your clients and customers

- How to keep things moving with your business

We’re not suggesting in any way that we have all the answers, but it is important for us to work with you and help you to plan for what will happen in the weeks and months ahead.

Contact us to book in a meeting to discuss your business situation and run through the attached continuity plan.

NEXT STEPS

There are times when we need to stay calm and rely on reliable news sources and information from State and Australian Government websites. What you see on social media may be panicky and unreliable information.

Our team at RA Business Advisors are here to help you. Please phone us on 07 3367 0852 or email us at mail@raaccountants.com.au if you need any assistance.

SG Amnesty Bill finally passes Parliament

The government’s superannuation guarantee amnesty bill has finally passed both houses, almost two years after it was first introduced.

The bill motivates employers to “come forward and do the right thing by their employees” by paying any unpaid super without facing serious penalties. The amnesty period will end six months from the date it receives royal assent.

Since the amnesty was announced on 24 May 2018, around 7,000 employers have come forward to voluntarily disclose historical unpaid super. According to Treasury, 7,000 more employers are estimated to come forward during the six-month amnesty period, returning $230 million of superannuation to employees.

For employers who are found to be underpaying their employees’ super, they will be subject to a minimum penalty of 100% of the SG shortfall they owe – and up to 200% in serious cases – if they fail to comply before the amnesty period ends.

According to Assistant Minister for Superannuation, Financial Services and Financial Technology Jane Hume, if employers do not take advantage of the amnesty, they will face significantly higher penalties when they are caught.

“We encourage employers to check they don’t owe outstanding super — and if they do, to take advantage of this once-only opportunity to set things right before much tougher penalties apply.”

New Year, New Decade

Not only did we celebrate a new year a couple of weeks ago, but we welcomed a new decade. It is at this time we find ourselves not only reflecting on the year that has just been, we are also reflecting on the decade that has just gone.

At the beginning of the last decade, our office operated quite differently. Looking back at 2010, we were just beginning to implement Xero and our processes were drastically changing into electronic form. All our correspondence was via snail mail, email was used sporadically to converse with clients; and working away from our desk was next to impossible due to all our files & software being on a server which we could only use via ‘Remote Access’.

This last decade has drastically improved our processes. So much so, that we would not want to return to where we used to be. Now, we are very proud Gold Xero Partners, well and truly using and loving our beautiful accounting software, all our correspondence is via email allowing instantaneous contact between ourselves and our clients, and all our files and software are ‘in the clouds’ which allows us to work away from our desks easily, and in turn, improving our work/life balance.

Trying to imagine where we will be at the beginning of next decade is mind boggling, but exciting!

For many people a new decade brings with it an increased sense of ‘New Beginning’ and starting with a ‘Clean Slate’. In small business, often the break between Christmas and New Year allows us time to evaluate the past and consider how we can tackle the coming year with improved efficiencies. How can we make our business grow, be more successful and find a better work/life balance. Perhaps, if you haven’t made the jump yet, this is your year to improve your data processing and bookkeeping by jumping onto Xero. It will most definitely not be a change you regret! For those of you who do use Xero, perhaps there is an add-on which you have been considering implementing – this is the time to jump on board. While you are feeling refreshed to tackle the year ahead, get the ball rolling, it’s the best time to implement a change.

From all of us at RA Business Advisors, we wish you a very successful year ahead!!

Directors beware: Penalties for Unpaid Super

Any unpaid superannuation is payable to the ATO after three months as a Superannuation Guarantee Charge (SGC). The ATO can issue a Director Penalty Notice for unpaid GSC and the Company Director’s personal assets can be sold to pay for the debts in the penalty notice. In other words, Company Directors can be held personally liable for the company’s unpaid superannuation.

If a company fails to pay superannuation, but it lodges its SGC Statements by the SGC Statement due dates, the ATO can issue a Director Penalty Notice to the company’s directors. The Directors can become liable to the ATO for the amount of SGC claimed in the Director Penalty Notice. Directors can avoid personal liability if the SGC is paid by the company.

If a company fails to pay superannuation and it also fails to lodge SGC statements by the SGC Statement due dates, the Directors are automatically personally liable for unpaid superannuation. In these circumstances:

- The ATO can estimate unpaid superannuation if it chooses

- The ATO can and will issue a Director Penalty Notice to recover superannuation from the Directors

- Placing the company in liquidation or voluntary administration will not avoid liability for the Directors

- The ATO can and will issue Director Penalty Notice after a company is already in liquidation or voluntary administration

In May 2019, new legislation was passed to change the date upon which company directors become automatically liable for SGC amounts. The new date is the date which SGC Statements are due, which are:

| Quarter | Period | Super Due for Payment | SGC Statement Due Date |

| 1 | 1 July – 30 September | 28 October | 28 November |

| 2 | 1 October – 31 December | 28 February | 28 February |

| 3 | 1 January – 31 March | 28 April | 28 May |

| 4 | 1 April – 30 June | 28 July | 28 Aug |

If your company cannot pay superannuation, the best thing to do to avoid liability is to lodge SGC Statements within three months of them being due. If this is done, then you will be able to avoid liability under any Director Penalty Notice issued by placing your company in liquidation, if this is the best option available. The ATO will also not be able to issue you with a Director Penalty Notice after your company has been placed in liquidation.

But if your company is unable to pay superannuation within three months of it being due, then it probably has some underlying financial problems and you should see advice regarding the company’s circumstances, strategies which may be put in place and risks to you as a Director personally.

Contact our expert Accountants for assistance if you have any questions about this information or if you need help in working out what to do if you have unpaid superannuation in your company. Don’t leave this too late. If you do, then your personal assets will be at risk!